Legal gambling in India has grown fast, with online games and fantasy sports bringing real money wins to players everywhere. Many don’t realise they need to pay tax on betting winnings, both from online and offline games.

Under the Income Tax Act, winnings are taxed under rules like Section 115BBJ and Section 194BA, with TDS on betting winnings often deducted by platforms.

Knowing how to report these winnings in your ITR helps avoid issues and keeps you clear on online gaming tax in India.

Paying Tax on Betting Winnings in India – Key Facts

- All betting winnings are taxable in India, regardless of the amount or platform used for betting activities.

- A flat 30% tax rate (plus surcharge and cess) applies to your gross winnings.

- Tax Deducted at Source (TDS) is often applied by platforms on winnings exceeding specified thresholds before payment.

- You cannot claim any expenses or losses to reduce your taxable winnings; the entire winning amount is subject to tax.

Disclaimer:

The information below reflects tax rules that applied before the new bill was introduced. After the new law, all online money-earning and betting apps are banned in India. However, this does not cancel taxes on winnings earned before the ban; those remain taxable at 30% under the Income Tax Act.

Betting Legality and Taxation In India

Betting legality varies across Indian states, but tax obligations remain consistent regardless of legal status.

India doesn’t have one clear law on whether online betting is legal. The rules come from a mix of old laws, new digital rules, and decisions by different states and courts.

Even with this, the Income Tax Act applies uniformly across India; all winnings from betting activities, whether legal or illegal in your state, must be declared and taxed.

The Income Tax Department of India does not differentiate between legal and illegal gambling winnings when deciding tax liability.

This means even if you participate in betting activities in states where it’s prohibited, you’re still required to pay taxes on any winnings received.

Additionally, it is crucial to note that most legitimate betting apps operating in India require Know Your Customer (KYC) verification before allowing withdrawals.

How Does Tax on Betting Winnings in India Work?

Betting winnings in India are taxed at a flat 30% rate under Section 115BB of the Income Tax Act.

This special provision ensures that gambling winnings are taxed separately from your regular income, meaning they don’t benefit from lower tax slabs.

The effective tax rate exceeds 30% due to additional levies – a 4% Health and Education Cess is added, making the total rate approximately 31.2%.

For high-income individuals, a surcharge may be applied, further increasing the effective tax rate.

The term “gross winnings” is crucial here; you cannot reduce your taxable amount by claiming expenses like stakes lost, platform fees, internet charges, or travel costs to betting venues.

The entire winning amount is subject to taxation, making it essential to set aside funds for tax obligations immediately upon receiving winnings.

Indian bettors can use international betting sites in India, but they should be licensed offshore.

How is TDS on Betting Winnings in India Applied?

TDS (Tax Deducted at Source) is automatically deducted by betting platforms or organizers when winnings exceed specified thresholds.

Online gaming platforms typically deduct TDS at 30% on winnings exceeding ₹10,000, while lottery and crossword puzzle winnings face TDS on amounts above ₹10,000.

The platform or organizer responsible for paying winnings must deduct this tax before disbursing funds to winners.

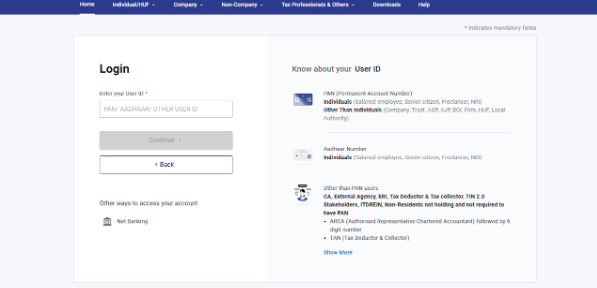

You can verify TDS deductions through Form 26AS, available on the income tax e-filing portal, which shows all TDS deducted against your PAN.

For example, if you win ₹50,000 from online betting, the platform deducts ₹15,000 (30%) as TDS, and you receive ₹35,000. This TDS amount is credited to your tax account and can be claimed when filing your income tax return.

Reporting Your Betting Winnings in Your Income Tax Return (ITR) in India

All betting winnings must be declared under the “Income from Other Sources” section in your ITR, regardless of TDS deduction.

Most individuals use the ITR-1 or ITR-2 forms, depending on their other income sources; however, those with business income may need to use the ITR-3 or ITR-4 forms.

In India, accurate disclosure of all winnings is mandatory; the tax department increasingly uses data analytics to cross-verify financial transactions and identify undisclosed income.

The TDS deducted by platforms appears as tax paid and reduces your final tax liability. If your total tax liability exceeds the TDS deducted, you must pay the additional amount.

For example:

If a platform deducts ₹30,000 TDS on your ₹1,00,000 winnings, and your total tax is ₹40,000, you’ll pay the extra ₹10,000. But if your total tax is only ₹25,000, you could get a refund for the extra ₹5,000.

Conversely, if TDS exceeds your actual liability, you can claim a refund. Maintain detailed records of all betting activities, including winning amounts, TDS certificates, and platform statements to support your ITR filing.

Consequences of Not Paying Tax on Betting Winnings in India

Failing to report betting winnings can result in significant penalties, interest charges, and legal action from tax authorities.

- Big Penalties

The Income Tax Department can charge 100% to 300% of the unpaid tax as a penalty, plus extra interest that keeps adding up over time. - Tracking by the Tax Department:

Tax notices can be sent based on computer systems that match data and large money transfers, including those from betting websites. - Reports from Banks and Payment Apps:

Banks and payment apps tell the tax department about big transactions, so it’s getting harder to hide betting winnings. - Legal Trouble:

If you don’t pay the tax, you could face legal action under the Income Tax Act and, in serious cases, you can be jailed.

Betting Read:

- Can I Bet on Tennis Matches from India

- Risks Of Using Illegal Betting Sites

- Sports Betting Legalized Status

Conclusion: New Bill Bans Online Gaming, Yet Earlier Winnings Stay Taxable

Tax obligations on betting winnings in India are clear and non-negotiable. All winnings are subject to a flat 30% tax rate plus applicable cess and surcharge.

No matter if you’re betting online or at any location, it is important to report your winnings and pay the right taxes to avoid fines or legal trouble.

Keep clear records, understand how TDS (tax deducted at source) works, and make sure to file your tax return on time. This helps you stay on the right side of the law and enjoy your betting winnings without worry.

FAQs

You can claim a TDS refund by filing your Income Tax Return if your total tax liability is less than the TDS deducted on your winnings.

You cannot offset betting losses against winnings or any other income; the full winning amount is taxed without deductions.

If your total tax liability (including from betting) exceeds ₹10,000 in a financial year, you are required to pay advance tax.

Fantasy sports winnings are taxed under Section 115BB at a flat 30% rate, similar to betting or lottery income.